Ingredients for Success in Value-based Payment: The Case of Medicare Advantage “Stars” Quality Ratings

Who succeeds when large payers, such as Medicare Advantage (MA), pay for value? A recently published study in Medical Care, “The Concentration of Physician Services Across Insurers and the Effects on Quality,” suggests that health plans that contract with physicians who are more exposed to the quality measures established under a value arrangement are more likely to succeed.1 In particular, health plans with contracted physicians who focus their Medicare practice on Medicare Advantage patients performed better on the CMS Star quality measures than physicians whose practice included a smaller than average share of patients enrolled in private Medicare Advantage plans. In short, it pays for health plans to contract with physicians who are going “all in” on value-based care.

Since 2012, Medicare Advantage (MA) plans, which compete to serve Medicare beneficiaries, have been paid more if they attain a defined quality Stars rating score.2 The CMS Star rating consists of approximately 45 quality measures. Since MA plans are “at risk” and paid a capitated monthly amount to provide almost all Medicare-covered Part A and Part B services (and Part D if the plan elects to offer a drug benefit), the inclusion of a quality component to the payment methodology makes MA payment “value-based” under most definitions of value-based payment.3

Key Findings

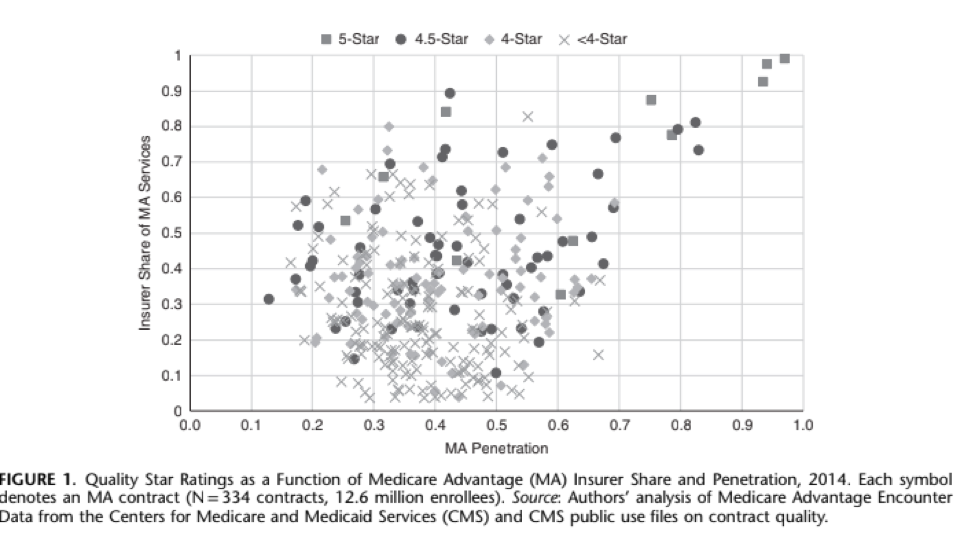

Merging Medicare Advantage encounter data from 2014 with publicly available Star ratings and individual measures, researchers W. Peter Welsh, Ph D, Aditi Sen, Ph D, and Michael Bindman, MD found that the higher scoring MA plans were more likely to contract with physicians who took care of a large share of Medicare Advantage enrollees relative to the total number of Medicare patients in their practice. This variable was named MA Penetration. They found that physicians participating in MA provided, on average, close to half of their Medicare services to patients enrolled in MA plans versus patients enrolled in traditional Medicare. Second, MA-participating physicians delivered, on average, close to half of their MA services with one insurer. This variable was named Insurer Share. When the MA Penetration rate was more than one standard deviation above the average MA Penetration rate, it was associated with a greater increase in quality Star rating than a one standard deviation increase in the Insurer Share measure (.33 v. .09 stars). Furthermore, the quality difference was larger when physicians were caring for disabled beneficiaries enrolled in MA contracts with a high proportion of disabled enrollees.

The Takeaway:

Contracting with physicians who have a high proportion of their patients enrolled in MA and are subject to the same set of MA quality measures appears to be a winning strategy for a Medicare Advantage health plan — already at risk for total costs — to earn more and achieve higher quality scores.

“These findings are consistent with the experience of high-performing health plans among our membership,” notes Ceci Connolly, CEO of the Alliance of Community Health Plans. “Since our plans are committed to their local communities, they tend to develop deep and durable relationships with physician groups and collaborate with them on quality improvement activities.”

Norman Chenven, MD, founder of Austin Regional Clinic and vice-chair of the Council of Accountable Physician Practices, concurred, noting that “once a physician practice commits to value-based care, they need to shift their entire practice in that direction in order to be both high-performing and sustainable. It’s gratifying to see these results in peer-reviewed research.”

Implications

The findings from Welsh, et al, suggest that from the physician perspective, “a greater concentration of services may be accompanied by increased investment in technology and other tools for patient and cost-management. Further, physicians may be more likely to respond to insurer incentives and goals if the majority of their business is with that insurer than if they work with multiple insurers.” (p. 799)

From the health plan or insurer perspective, the authors suggest that “greater concentration with affiliated physicians may give the insurer more control over services and costs. More concentration would also allow insurers to accrue the full benefits of any cost savings or quality improvements that occur due to changes in practice. Thus, insurers may be more likely to invest in quality improvement processes and programs and any such initiatives may be more effective.”

The study results and implications noted by the authors resonate with the physician groups which comprise CAPP, the Council of Accountable Physician Practices. They reinforce our collaboration efforts with health plans to align incentives toward value while minimizing the administrative cost associated with managing differences in measurement and definitions across plans.

What’s Next?

The Welsh, et al study analyzes the relationship between Medicare Advantage health plan payment (at the MA contract level) and physician concentration in Medicare Advantage. It does not look at the payment arrangement between the health plan and its contracted physicians, which is the real focus of the transition to value-based payment. The structure of payment and other model design features between Medicare Advantage plans and physician groups is important research for further understanding the factors for success in value-based payment arrangements.

1 https://journals.lww.com/lww-medicalcare/Abstract/2019/10000/Concentration_of_Physician_Services_Across.8.aspx

2 For an explanation of the history of the stars quality bonus program and other details, see https://innovation.cms.gov/Files/reports/maqbpdemonstration-finalevalrpt.pdf

3 Also called “alternative payment models”, for more on the definitions for value-based care, see http://hcp-lan.org/workproducts/apm-factsheet.pdf